Will my North Carolina car insurance go up if I have an accident or claim?

It’s a question I get almost everyday, “Will my North Carolina car insurance go up if I have an accident or claim?” And borrowing from a line from my college professor Mr. Burns (not The Simpsons character) “It all depends”.

There are so many things that will impact this answer.

I get it you’re worried about how much you’re going to pay for car insurance.

It’s an expensive bill each month, but is it really more than your other bills?!? Is it more than your cell phone, your cable bill, or your Starbucks addiction?

Okay maybe the Starbucks thing is a stretch unless you are the type of person that orders a Trenta iced skinny hazelnut macchiato, sugar-free syrup, extra shot, light ice (is it heavier than regular ice #dadjoke), no whip on the daily. No judgement here. (Full disclosure I don’t drink coffee and had to Google that.)

There are many, many factors that you have to take into consideration:

Who is your auto insurance company?

What kind of auto policy do you have with them?

When did you buy insurance from that company?

How much was paid out to fix your car, the other driver’s car, and other people’s medical bills?

We are going to dive into each of these so that at the end you’ll be able to answer at the end “Will my North Carolina car insurance go up if I have an accident or a claim?”

Before we get to those four questions we need to look at the definition of an accident and a claim.

What is the difference between an accident and a claim?

While there is not an official definition that I can point here’s my unofficial definition.

An accident is when your car hits another car or an object like a tree or guardrail. The damage to your car will be repaired using your collision coverage on your auto policy. The other driver’s car will be repaired under you property damage coverage on your auto policy. You will have insurance points which will make your insurance more expensive.

A claim is when your car is damaged by something else such as fire, theft, vandalism, hail, or hitting an animal. The damage to your car will be repaired under your comprehensive/other than collision coverage on your auto policy. You will not have insurance points to make your insurance more expensive.

The key to remember here is that an accident is collision and a claim is comprehensive/other than collision.

Who is your auto insurance company?

This is truly going to be the deciding factor when it comes to answering the question, “Will my North Carolina car insurance go up if I have an accident or claim?”

Today you are bombarded my commercials telling you that you can save hundreds by switching to them and that they offer Accident Forgiveness. The unfortunate part is that typically there’s small print at the bottom that says it’s not available in North Carolina.

I know, I know, it’s not fair and I completely agree.

The good news is that there are several companies in North Carolina that offer this coverage, and we represent two of them.

But not all insurance companies are created equally and they do not offer Accident Forgiveness the same way. There are four companies that I know of (there may be more) that offer Accident Forgiveness in North Carolina.

Erie Insurance

This is a company that the Lipstone Insurance Group represents and in my opinion is the best when it comes to Accident Forgiveness.

Erie Insurance offers First Accident Forgiveness from day one, there’s zero cost, and no requirements for previous accident.

That’s right!

It starts right away.

Erie charges $0 to have Accident Forgiveness.

You don’t have to worry about having a “clean” driving record for the last three or five years.

They will not apply Accident Forgiveness to accidents that you’ve had in the past and switch to them. It’s a good thought if you had it, but unfortunately insurance doesn’t work that way.

With Erie’s First Accident Forgiveness your car insurance won’t increase because of insurance points like it would with other companies that don’t offer it.

This can save you up to 60% per year for a three year period and can mean being able to afford your Grande, nonfat latte with 2% foam on the daily.

Hartford Insurance

The Hartford offers First Accident Forgiveness to their new clients, but there’s a twist to it from what Erie Insurance offers.

The good news is that there’s no cost to you, so you won’t have to pay for it unlike the other companies. We’ll get to in a moment.

The downside to Hartford Insurance is that you have to wait, and wait a long time. In order to have this valuable coverage added to your policy all drivers on your policy have to be at-fault accident free for five years.

Yes, you read that correctly.

5 years.

It’s great that they offer this coverage, but that’s a long time to wait.

I mean by that time you may have a new President of the United States. Or man buns will be back in style. Or choker necklaces will be the size of a neck brace by then (I think that’s still a thing in 2018).

Nationwide Insurance

Nationwide Insurance offers First Accident Forgiveness to their new clients, but there’s a twist from what Erie Insurance and The Hartford offer.

Just like Erie you’ll get First Accident Forgiveness from day one. This is great news, but there’s a catch.

Unlike Erie and Hartford where they provide it to you for free, you’re going to have pay to add this coverage to your North Carolina auto policy.

It’s great that you’ll have it from the beginning, but having to pay for it kind of takes the benefit out of having it. Maybe that’s just me?

Safeco Insurance

Safeco Insurance is another company that our agency represents and the final company that I know of in North Carolina that offers Accident Forgiveness.

With Safeco Insurance you have to pay for it and there’s a waiting period.

You’ll add it to the policy as part of the Enhanced coverage which has a cost to it.

Then you need to be at-fault accident free for three years.

Once that’s happened, then you’ll have Accident Forgiveness on your auto policy.

That’s a lot of steps to receive this coverage.

On the bright side you don’t have to wait to vote for the next President, you’ll just have to wait almost as long as it took Walt Disney World to build the Seven Dwarf’s Mine Train attraction at Magic Kingdom.

What kind of auto policy do you have with them?

Erie Insurance offers two auto policies for their clients. One under the sub-company name “Erie Insurance Exchange” which provides First Accident Forgiveness coverage. The other under the sub-company name “Erie Insurance Company” which does not provide First Accident Forgiveness coverage.

You’ll want to review your policy with your Erie Insurance agent to see if you have this valuable coverage. (You can also look at your auto declaration page or auto ID card to see this information.)

With The Hartford and Safeco Insurance they do not have two policies that you need to worry about. With Nationwide Insurance I believe there are different kinds of policies that do not allow you to add Accident Forgiveness to it. I would recommend if you speak with an agent that represents these other companies to confirm the availability of Accident Forgiveness.

When did you buy insurance from that company?

In addition to First Accident Forgiveness Erie Insurance offers Feature Fifteen to reward their loyal clients. This is why many of our clients have been with Erie Insurance for over fifteen years.

Once you’ve had car insurance with Erie for fifteen consecutive years they will add Feature Fifteen to your policy.

This coverage means that you will not be charged the insurance points for any at fault accidents for the life of the policy. Keep in mind that if you have several at-fault accidents Erie may cancel your policy.

When it comes to Erie it really does matter when you first purchased your policy from them.

The other insurance companies; The Hartford, Nationwide Insurance, and Safeco Insurance, do not offer this type of coverage.

How much was paid out to fix your car, the other driver’s car, and other people’s medical bills?

How many insurance points will I have?

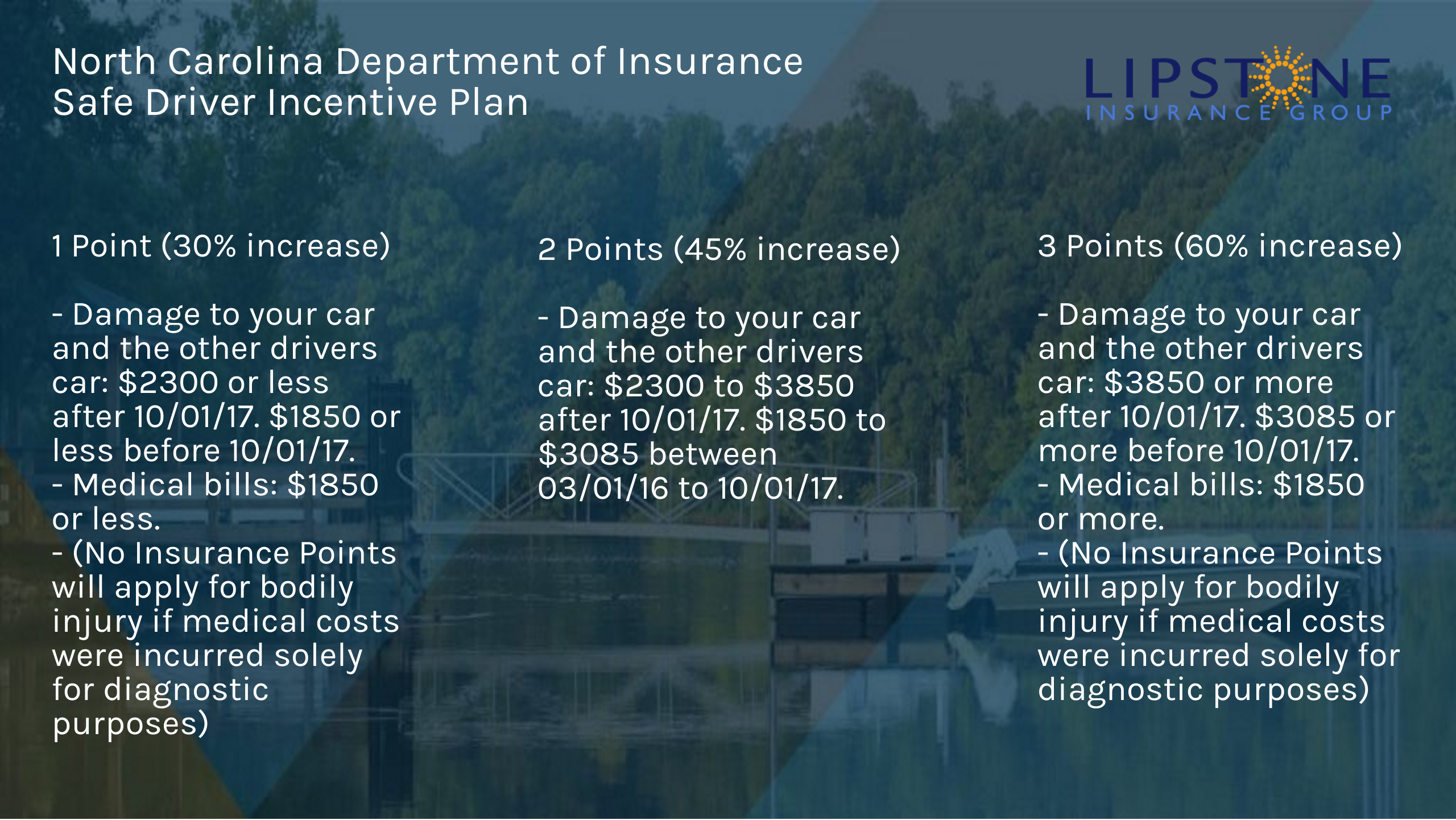

In North Carolina you can be assigned insurance points for at fault accidents covered by your collision coverage and the number of points will depend how much is paid out for the accident. The more that the insurance pays to repair your car, the other driver’s car, and other people’s medical bills the higher the number of insurance points you’ll receive.

You can be assigned 1, 2, or 3 insurance points based on how much was paid for the accident. Check out the handy-dandy, fancy graphic below for more information:

Here’s how the insurance points will impact your car insurance policy:

- The insurance points will be added to your policy on the next renewal date.

- They will be charged for a three year period.

- They will be charged on the most expensive car on the policy. (When insurance companies say the most expensive car it’s not necessarily based on the value, but rather a standardized system that all insurance companies use.)

You may be wondering when exactly the insurance points come off your policy.

Wait, did I just read your mind?!? I think I did.

The insurance points will come off once the accident is three years old and the policy renews. You may think, but wait I thought once it’s been three years I’m done. I shouldn’t have the points on my record.

The reason that you have to wait until the renewal is because the insurance company didn’t add the insurance points the day after the accident. They waited until the policy renewed.

How much will my North Carolina car insurance go up because of insurance points?

This may be the most frustrating part of my job. Not being able to tell my clients exactly how much their insurance can go up because of insurance points.

I have guidelines that I can go by as illustrated by that snazzy graphic above.

What I do want to do is give you an idea based on a recent client I helped with their auto, home, and umbrella insurance with Erie Insurance.

Here are the details of this client:

- Married couple

- Late 20s/early 30s

- 2 vehicles: 2008 Volkswagen Jetta & 2015 Kia Optima

- Liability limits: $250/500/100

- Deductibles: $500 collision & $500 comprehensive

Here’s what happens when they have 0, 1, 2, or 3 insurance points:

- 0 insurance point: $1759.84 annual premium

- 1 insurance point: $2089.28 annual premium (19% increase)

- 2 insurance points: $2424.38 annual premium (38% increase)

- 3 insurance points: $2601.61 annual premium (47% increase)

I’m sure there are a few things you noticed from this scenario that we should talk about.

First, is that even with insurance points the premiums did not increase the maximum amount that is allowed. Remember 1 point is 30% and it only went up 19%, 2 points is 45% and it only went up 38%, and 3 points is 60% and it only went up 47%.

Second, if this person was able to use their First Accident Forgiveness coverage they would save almost $850 per year and over $2500 for a three year period. This coverage truly puts money back into your pocket all because you had First Accident Forgiveness.

FYI, if you want to know why your auto insurance may have gone up in the last year without any accidents, claims, or tickets check out my article called Why did my North Carolina car insurance go up?.

Final thoughts

We all know that accidents are going to happen, that’s why they’re called accidents and not purposes #dadjoke. (Can I tell jokes if I’m not a dad though???)

What you can do to keep the cost of your North Carolina auto insurance down is to have a company that provides Accident Forgiveness and there are great options to choose from in North Carolina.

If you’d like to learn more about this coverage, then click the button below to schedule a call.

You can always start the process to find out if you would fit with Erie Insurance by filling out the information below.