“Hi, Josh this is Hank Albert and I want to talk to you about my car insurance.” And before he says anything else I almost know that the next sentence out of his mouth will be:

Why did my North Carolina car insurance go up?

And I get it, I truly get it. You think that each year your car insurance should go down. Am I right?

And generally the next question is “Well why doesn’t my car insurance go down each year?”

But here’s the reality of things. It generally will not go down each year and we’re about to find out why together.

Are you ready? Let’s go!

Car Insurance Rate Increases

Let’s get the big one out of the way. The one that no one wants to really talk about, rate increases.

North Carolina car insurance companies sometimes need to take rate increases. What does this mean to you? This means that your car insurance will go up regardless of anything that you do.

Is it fair? Yes and no.

Do I want to pay more for my own car insurance? No, I don’t, but I understand why I need to.

And before we go any further let me dispel a huge rumor and myth in the insurance industry. When I buy insurance I do not receive a discount. It’s not like working for a company that gives an employee discount.

You may, or may not be aware, that all North Carolina car insurance companies are subject to the rates that the North Carolina Rate Bureau recommends and what the Insurance Commissioner approves for them. Here’s how it works in a nutshell:

- The insurance companies submit request for a certain rate increase which is then passed along to the North Carolina Rate Bureau.

- The North Carolina Rate Bureau then files a proposal with the Department of Insurance requesting an X% rate increase.

- The Department of Insurance then reviews the request and will make a ruling whether to accept or deny the request along with the X% increase or decrease they are willing to approve.

Now let’s look at it from a non-insurance point-of-view and let’s say you own a restaurant. You’re a restaurant owner and you know that the cost of buying food is going to go up next year. You realize that in order to make money this year you need to raise your prices or you won’t make a profit. You have the ability to increase the cost of the Spicy Tuna Roll or your Bacon Double Cheeseburger, your customers understand and are willing to pay the extra money because they want you to stay in business.

Now let’s change this scenario to an insurance company. Instead of being able to do the same thing as the restaurant owner you have to ask permission by a government agency to raise your rates. The government agency, in this case the North Carolina Department of Insurance, decides that not only should you not raise your rates, but they have the ability to tell you to decrease your rates.

Does this seem fair to you?

I’ll leave that answer up to you.

Speaking of the North Carolina Rate Bureau and rate increase requests one was just made last month on February 2, 2017. This is the first proposed change by the Rate Bureau since 2009 and the request is an average of 13.8%.

According to the news release (North Carolina Rate Bureau 2017 Automobile Filing) there are four main reasons why the request has been made:

- According to the North Carolina Division of Motor Vehicles in 2015 fatalities increased 8.1%, injuries increased 11.8%, and reported crashes were up 11.1% from 2014.

- In 2015 the number of miles driven is up from the average of the preceding five years by 13% and it is believed to be the most significant factor in the increase of losses.

- Inflation in 2016 has increased vehicle repairs costs by 2.4% and total medical care costs by 3.8%.

- According to estimates by the North Carolina Department of Motor Vehicles in 2015 there were 7% more crashes due to distracted driving and 13.2% more alcohol related crashes.

Another factor that comes into play is the North Carolina Recoupment Fee that is added onto all car insurance policies. Think of this like a sales tax for your car insurance and something that is somewhat unique to North Carolina car insurance policies. Here are the last four rate fees:

- October 1, 2014 to September 30, 2015: 4.86%

- October 1, 2015 to September 30, 2016: 4.06%

- October 1, 2016 to March 31, 2017: 8.26%

- April 1, 2017 to September 30, 2017: 9.94%

As you can see there has been an increase over the last year regarding this fee that all drivers in North Carolina have to pay and may be the reason that your car insurance went up.

Car Insurance Companies are For Profit Businesses

Insurance companies are in the business to make money. A handful of consumers operate under the belief that insurance companies should pay for any and all claims regardless of profit.

I know this sounds a little harsh, but it’s the reality that we live in.

Think about this for a moment in case you just furrowed your brow at this idea. Warren Buffett owns Berkshire Hathaway and Berkshire Hathaway owns GEICO Insurance. Do you think Warren Buffett doesn’t want to make money from owning GEICO Insurance?!?

Of course he does and so does every person that owns Berkshire Hathaway stock.

Accidents, Claims, and Tickets Oh My

Just like Dorothy in the Wizard of Oz we have to worry about the dreaded Accidents, Claims, and Tickets Oh My!

This is where the conversation usually turns to more of an understanding, but even still people aren’t pleased to hear that their rates will go up because of an accident, claim, or ticket.

Let’s first take a look at accidents and claims because they generally go hand-in-hand with one another.

There are a few different types of accidents that you can have:

- At fault accident

- Not at fault accident

- Comprehensive, or Other Than Collision claim

At Fault Accident

In North Carolina we follow pure contributory negligence law and we are one of four states plus the District of Columbia that follows this law. The other states are Alabama, Maryland, and Virginia.

What this means is that if a driver is 1% at fault in an accident, then both drivers are at fault in the accident. I wish this was not the case in our state, but unfortunately it is the reality that we live in.

Depending upon the amount that the insurance company pays out for an at fault accident for bodily injury (the other driver and passengers injuries), property damage (the other driver’s car and/or physical property), and collision (your car) will depend upon how many insurance points that you are charged. Here’s the breakdown as of March 1, 2017:

- 1 insurance point: $0-1850

- 2 insurance points: $1851-3084

- 3 insurance points: $3085 plus

Not At Fault Accident

Good news, well it’s never good news that you were involved in an accident, but you were in an accident and the other driver was 100% at fault.

FYI, when the other driver is at fault in the accident I recommend that you file the claim with their insurance company. You have the option to file with your own insurance company, but I recommend you start with the other insurance company.

Comprehensive, or Other Than Collision, Claim

There are generally ten different scenarios where you can file a Comprehensive, or Other Than Collision, claim which are sometimes referred to as Acts of God claims:

- Missiles or falling objects

- Fire

- Theft or larceny

- Explosion or earthquake

- Windstorm

- Hail, water, or flood

- Malicious mischief or vandalism

- Riot or civil commotion

- Contact with bird or animal

- Breakage of glass

The most common claims are falling objects, hail, vandalism, contact with a bird or animal, and breakage of glass (I know I just gave you half of the list), but the majority of the claims that my clients experience have to do with something like a tree falling on their car, hail damage to their car, someone vandalizing their car, hitting a deer, and the number one claim is damage to your windshield.

Tickets

Instead of listing out the entire list of things that can be considered a ticket I’ll give you the most popular tickets that I see:

- DWI/DUI: 12 points

- Driving while license suspended/revoked: 8 points

- Speeding: 1-4 points

- Improper signal, turn, use of lane: 1 point

- Passed stopped school bus: 4 points

- Running a red light: 1 point

- Safe movement violation: 1 point

What you need to know about tickets is that it is based upon what you are convicted of and not what you are charged with. For example, you receive a speeding ticket of 70mph in a 55mph zone which is a 2 point ticket. However, when you go to court the ticket is reduced to 64mph in a 55mph zone which is now a 1 point ticket.

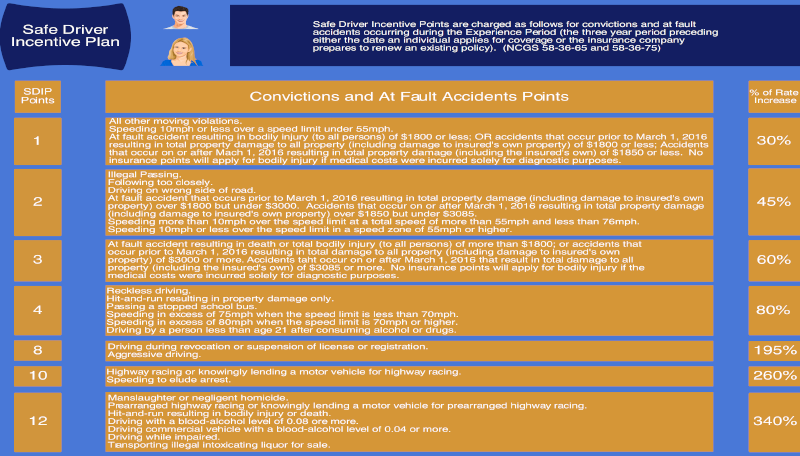

North Carolina Insurance Points (Safe Driver Incentive Plan)

If you have an at fault accident and or receive a ticket you will most likely end up with insurance points being charged on your car insurance. There are a couple exceptions to when there aren’t insurance points charged, but that’s a topic for another day.

The insurance points will be charged on your policy for three years plus your renewal date. Here’s how it works:

Your car insurance begins on January 1, 2017 and you receive a speeding ticket on February 14, 2017. You go to court on March 20, 2017 and you are convicted of a 2 point speed. When your policy renews on January 1, 2018 you’ll have 2 insurance points on your record. When your car insurance renews on January 2, 2021 the 2 insurance points will come off of your record.

The reason that the insurance points won’t come off your policy on March 20, 2020 is because they insurance company didn’t start charging you the 2 insurance points until the policy renewed on January 1, 2018. If you have any questions about this just call or email me.

Insurance Score

This is one of the most complicated subjects to discuss, and often a topic that people want to avoid. When we use the phrase Insurance Score it is referring to a credit-based statistical analysis of an individuals potential to file an insurance claim. Insurance companies believe that this gives them a better assessment of risk exposure and to predict future losses.

Did I lose you there?!?

Here are some of factors that an insurance company will include in the insurance score and they are derived from a credit report:

- Outstanding debt

- Length of credit history

- Late payments

- Public records of bankruptcies, judgments, or liens

- New applications for credit

- Types of credit used

- Available credit and payment patterns

Here are some factors that an insurance won’t include in the insurance score:

- Income

- Race

- Gender

- Religion

- Marital status

- National origin

- Geographic location

An insurance company is looking at long-term patterns and overall responsible use of credit when determining an individual’s insurance score. What may be the most frustrating aspect of this is that some insurance companies do not disclose what the insurance score and something that I hope the industry will change in the future.

What can I do to make my North Carolina car insurance less?

It’s like you’re reading my mind.

There are many different things that you can do to make your North Carolina insurance less and here are a few tips to get started:

- Have your car and home insurance with the same company.

- Be a safe driver. Avoid receiving any tickets, hitting other cars, or filing claims. (I know easier said than done.)

- Buy stock in the insurance company you are with. (Okay I know this seems a little far fetched, but if the insurance company you are with is doing well since they are a for profit company you can benefit from their profits.)

- Maintain a good credit score.

- Review your coverage to see if you should make any changes every few years. (You may not need comprehensive and collision coverage on a 1998 Honda Accord.)

If you found this article helpful and would like us to review your current car insurance needs, then contact us today. To make life easier for you I’d recommend you setup a 30 minute phone call with me by clicking the button below: